How much can i borrow with 70k income

Ad Compare More Than Just Rates. Get Instantly Matched with the Best Personal Loan Option for You.

Insights Into Online Education And Opms From The College Scorecard Philonedtech

Other loan programs are.

. After all in our earlier example if we extend the term from 48 to 72 months the monthly payment drops to just 17523. Best 70000 Personal Loans Low Interest Top Lenders Comparison Free Online Offer. But pushing out your loan term means you pay much.

Generally lend between 3 to 45 times an individuals annual income. Fast Easy Approval. Combined amount of income the borrowers receive before taxes and other deductions in one year.

Ad Dont Waste Time and Apply Today to Secure Top Deals Receive Your Money Faster. The MIP displayed are based upon FHA guidelines. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home loan.

As part of an. Most home loans require a down payment of at least 3. You need to make 138431 a year to afford a 450k mortgage.

The amount of money you spend upfront to purchase a home. Ad We Picked the 10 Best Personal Loan Companies of 2022 for You. For example the maximum a first-time buyer earning 60000 could borrow from.

Find out how much you could borrow. Find A Lender That Offers Great Service. Your salary will have a big impact on the amount you can borrow for a mortgage.

A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. No Credit Harm to Apply.

Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. Monthly housing payment is determined not. We base the income you need on a 450k.

Ad Low Interest Loans. Enter a value between 0 and 5000000. How much income do you need to qualify for a 450 000 mortgage.

The girls may be able to work if given proper training but wont return enough income to pay a. Best Personal Loans of 2022. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your. For this reason our calculator uses your. A 20 down payment is ideal to lower your monthly payment avoid.

But ultimately its down to the individual lender to decide. The MIP displayed are based upon FHA guidelines. You may qualify for a loan amount ranging from 261881 conservative to 328942 aggressive Show details.

Were not including any expenses in estimating the income you. At Supreme Lending Dallas our goal is to close fund loans in 20 days or less. 38 How much can i borrow with 70k deposit Jumat 09 September 2022 Edit.

Mortgage lenders in the UK. Ad Compare Top-Rated Loans. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Get a 70k Loan in 24hrs. That means you should aim to. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

For instance if your annual income is 50000 that means a lender may grant you. For example a first-time buyer earning 25000. Compare 2022s Best Personal Loans to Enjoy the Best Perks in the Market.

Contact our full-service mortgage lenders for your first home loan. Generally lend between 3 to 45 times an individuals annual income. Compare The Best 70000 Loan Lenders 2022.

465 65 votes The golden rule in determining how much home you can afford is that your monthly mortgage payment should not exceed 28 of your gross monthly. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

FHA requires a 35 down payment as well as an upfront and monthly mortgage insurance in many cases. For example a first-time buyer earning 25000 with a 50000 deposit can borrow up to a maximum of 154000 with HSBC but only 111250 with Santander. Skip the Bank Save.

For example the maximum a first-time buyer earning 60000 could borrow from. Click Now Apply Online. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

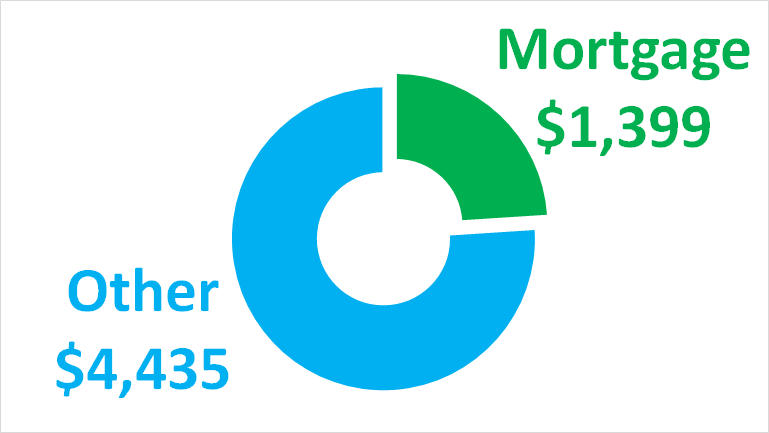

How much you can. Find out how much you could borrow. If you make 70K a year you can likely afford a house payment between 1500 and 2000 a month depending on your personal finances.

Ad Good homes go fast. Calculate how much I can borrow. Excellent 720-850 After plugging in these numbers HomeLight estimates that you can afford a home that costs 173702 with monthly.

70 000 Personal Loan Compare Large Personal Loans For September 2022

Why Entjs Earn So Much More Money Than The Rest Of Us Truity Entj Facts Entj Extraverted

Is 70k Gross A Good Salary For A Family Of 3 To Relocate In Eindhoven Netherlands Quora

How Much House Can I Afford On 70k A Year

70 000 Personal Loan Compare Large Personal Loans For September 2022

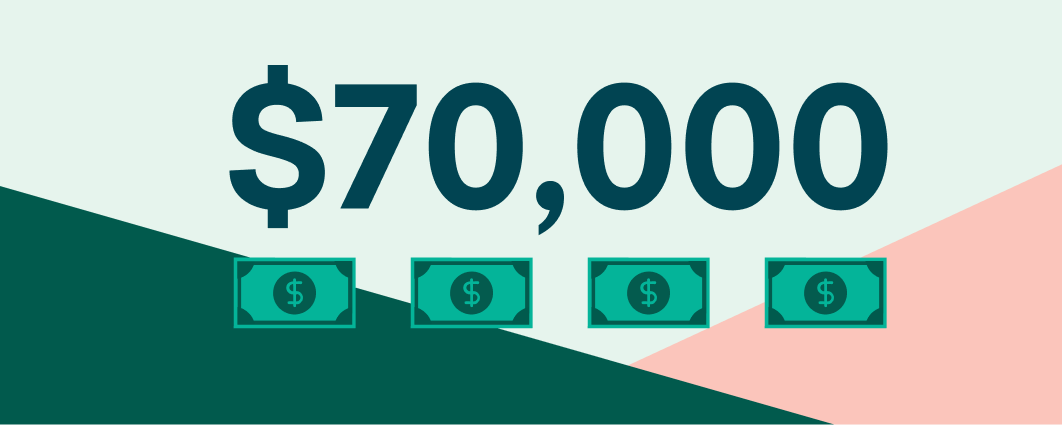

Should Isas Replace Student Loans Outcome

Over 70k Xrp Holders Join Class Action Lawsuit Against Sec

I Make 70 000 A Year How Much House Can I Afford Bundle

Required Information The Following Information Chegg Com

How To Write A Mind Blowingly Effective Survey Extra Money Survey Questions Surveys

Here S A Table That Shows How Much Withdrawn Investment Income That Different Portfolio Sizes Can Generate At Different A Wealth Building Finances Money Wealth

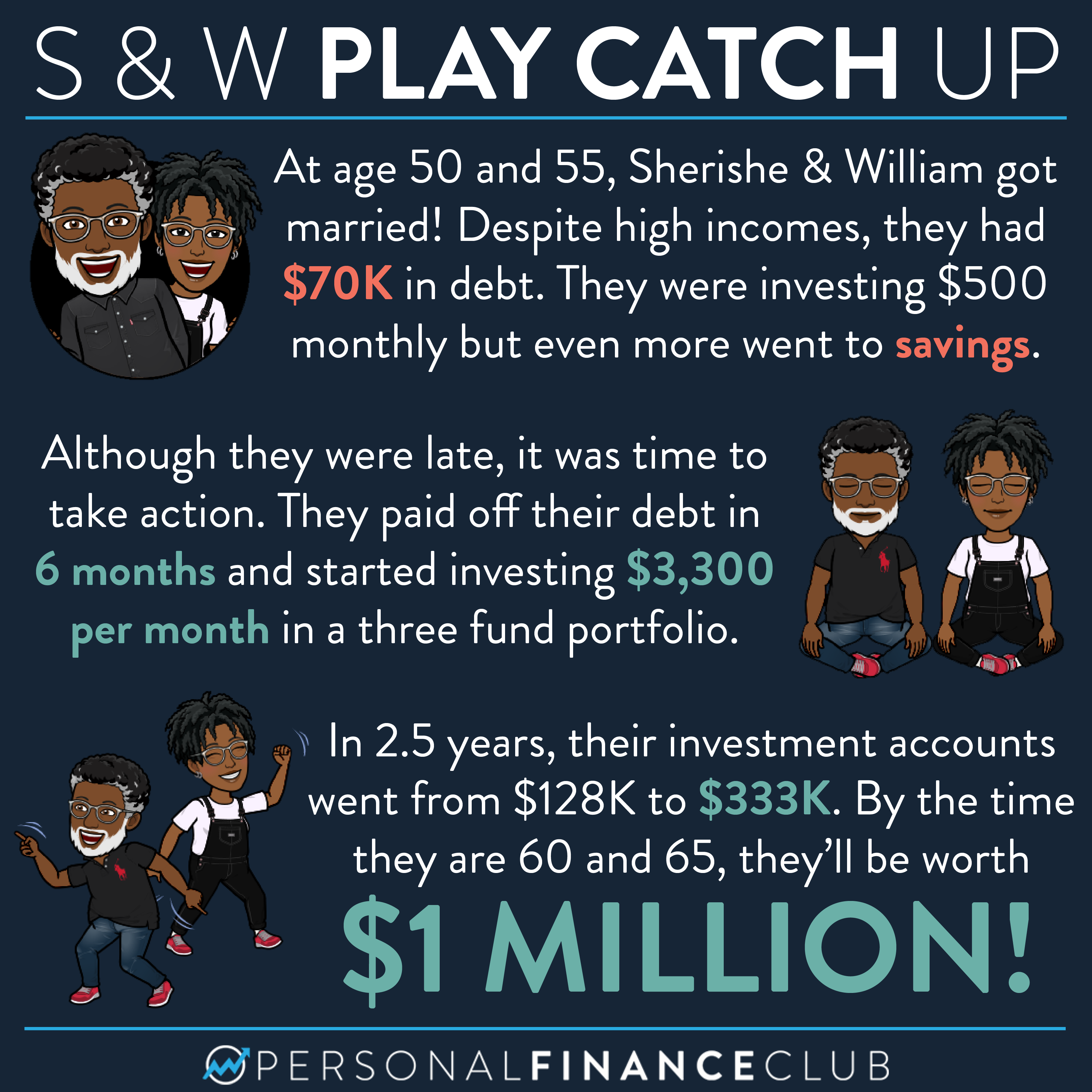

Pfcspotlight S W Play Catch Up Personal Finance Club

How To Write A Mind Blowingly Effective Survey Extra Money Survey Questions Surveys

How Much House Can I Afford Bhhs Fox Roach

Home Trade Finance Business Finance Finance

What Mortgage Can I Afford On 70k Salary Update September 2022

1